For the past 40 years or so, bond investors have, in a sense, been spoiled by an almost continuous fall in yields from over 14% in the 1980s, which – as bond prices move in the opposite direction to yields – resulted in strong capital gains in addition to the income received. That may have felt good at the time, but each time yields fell it simply reduced the future returns from bonds from that point forwards. UK 5-year gilt yields, for example, eventually reached a point – 0% – where they delivered no expected return at all, even before inflation was taken into account. The insurance premium for owning high quality bonds to balance a portfolio against equity market falls was very high, but there was not much one could do to avoid this.

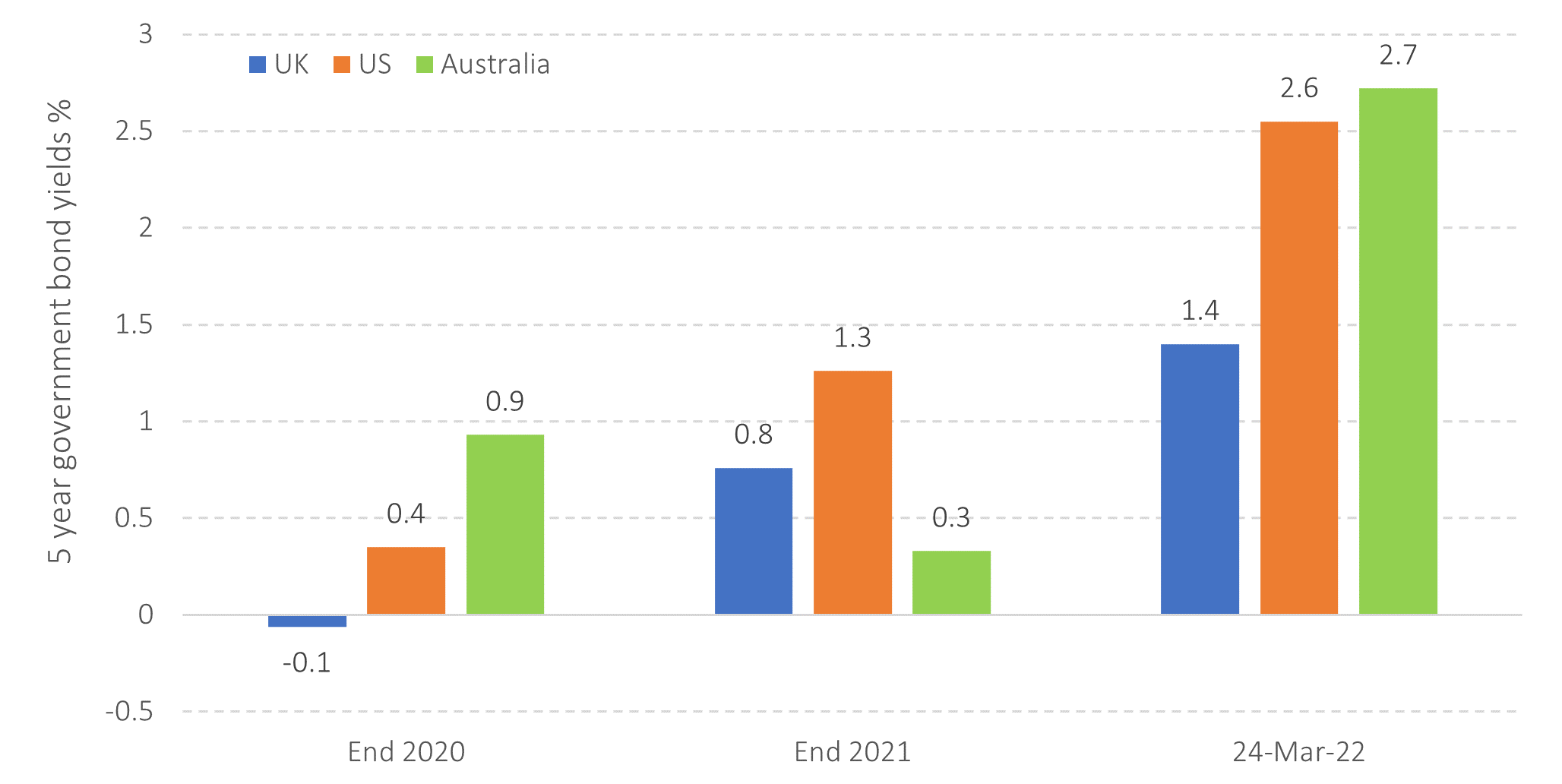

If you ask any investor if they would like higher or lower returns in the future the answer is a given. Today the Bank of England’s base rate is only 0.75%. Fortunately, short-dated, high-quality bonds in a number of major markets are now yielding in the region of 1.5% to 2.5% as yields have risen quite substantially over the past few weeks, as markets have begun to reflect the risks of higher-for-longer inflation. The chart below shows what has happened to various global bond yields since the end of 2020. Going forwards that is a good thing.

Figure 1: Bond yields have been rising fast

Data source: UK – Bank of England, US – Federal Reserve, Australia – Reserve Bank of Australia

Unavoidably, the short-term cost of attaining higher yields is small capital losses on shorter-dated bonds. These should be viewed in the context of the potential downside of equities at times of poor markets and other bond alternatives. For a longer-term investor this should be seen as a price worth paying for higher future returns.

To illustrate the point, imagine that you bought a bond yielding 1% a few weeks ago, but yields demanded by investors to own these bonds have now risen to 3%. If you wanted to sell your bond no-one would buy it at a 1% yield, but you might find a buyer if you dropped your price, thus raising their yield. Markets work pretty well and once its price fell to deliver a yield of 3%, you would start getting bids.

Although you suffered a capital loss[1], your bonds now have a higher yield going forward, which will compensate you for this loss over time[2] and deliver a higher return thereafter. That is a good thing for any longer-term investor.

The news potentially gets better. Today, there is quite a steep difference between cash rates and five-year bonds in some markets. As a hypothetical example, if you hold a five-year bond for a year, it becomes a four-year bond, and its yield will reduce. We also know that yield falls lead to price rises. So, our expected return from owning bonds will therefore be the sum of the yield-to-maturity on the bonds held plus any capital gain that might arise from a steep bond yield curve (this is known in the bond world as ‘roll-down yield’). Note though that there are no guarantees that this extra return will be collected as market yield movements, which are random in nature, may change the picture.

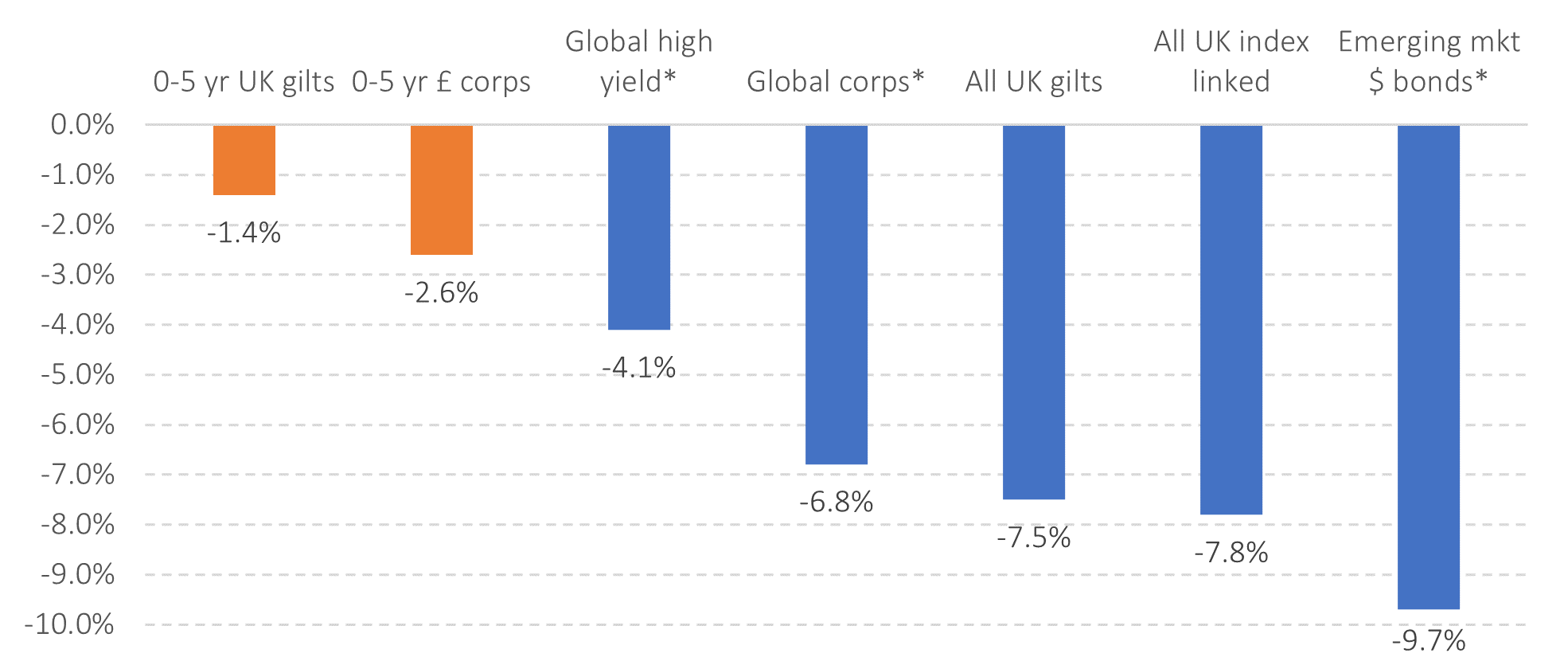

It is also worth noting that the yield rise impact has been materially less severe in high quality, shorter-dated bonds than for longer-dated and lower quality bonds, as the chart below illustrates.

Figure 2: Longer-dated and lower quality bonds have taken more pain in 2022

Source: YTD to 30-3-2022. Various ETFs (see endnote). * = hedged to GBP

In reality, no one knows if yields will rise again, stay the same or fall. Remember that if there was any certainty in which direction yields should move, they would already have moved! If they do rise again, owners of bonds will take a bit more pain, but they will end up in an even better place with yet higher expected future returns. Patience and a long-term view are required.

No pain, no gain.

[1] The actual amount of the loss is equivalent to the duration of the bonds multiplied by the rise in yields e.g. 3 year bonds with a 1% yield rise will fall by 3%. Duration is similar to the maturity of the bonds.

[2] In practice, the time it takes to recoup these losses and begin to benefit from the higher yields is equivalent to the duration of your bond portfolio. Short-dated bonds take less time than longer-dated bonds to start benefitting from higher yields.

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Endnote – Figure 2 data series:

iShares UK Gilts 0-5yr ETF GBP Dist., iShares £ Corp Bond 0-5yr ETF GBP Dist., iShares Global HY Corp Bd ETF GBP H Dist., iShares Global Corp Bond ETF GBP H Dist., iShares Core UK Gilts ETF GBP Dist., iShares £ Index-Lnkd Gilts ETF GBP Dist., iShares JP Morgan $ EM Bd ETF GBP H Dist.

![]()

About the author

Albion Strategic

Albion were born in 2001 and initially focused on working with private banks and family offices in the US. In 2006, it began consulting to leading financial planning companies in the UK, many of which have grown into robust, successful and respected firms with strong regional brands.

In that same year, Smarter Investing was published and is now in its third edition. Their systematic approach to investing was tested in the Credit Crisis of 2008-9 and survived with honours. The Albion approach has also been shown to be robust in the more positive markets since, capturing the bulk of returns offered by the markets.

Theory, evidence, logic and patience are the key ingredients to investing success.