Over the longer term, investors expect a positive, after inflation return from investing in company shares and lending money to governments and companies by owning bonds. Unfortunately – and inescapably – in the shorter-term market returns are anything but predictable. They contain a lot of noise, as the market absorbs new information into prices. High inflation in 2022 led to a rapid rise in interest rates around the world, contributing, in part, to the fall in global bond and equity prices. It was a painful backward step and a reminder that the road to long-term returns can be bumpy and painful at times. With these now higher yields, some investors may have been tempted to hold more cash but roll forward a year and that would have been a poor decision in the short term. It is nearly always a bad decision in the long term for those with long investment horizons. Fortunately, 2023 has delivered a much more positive story.

Looking backwards

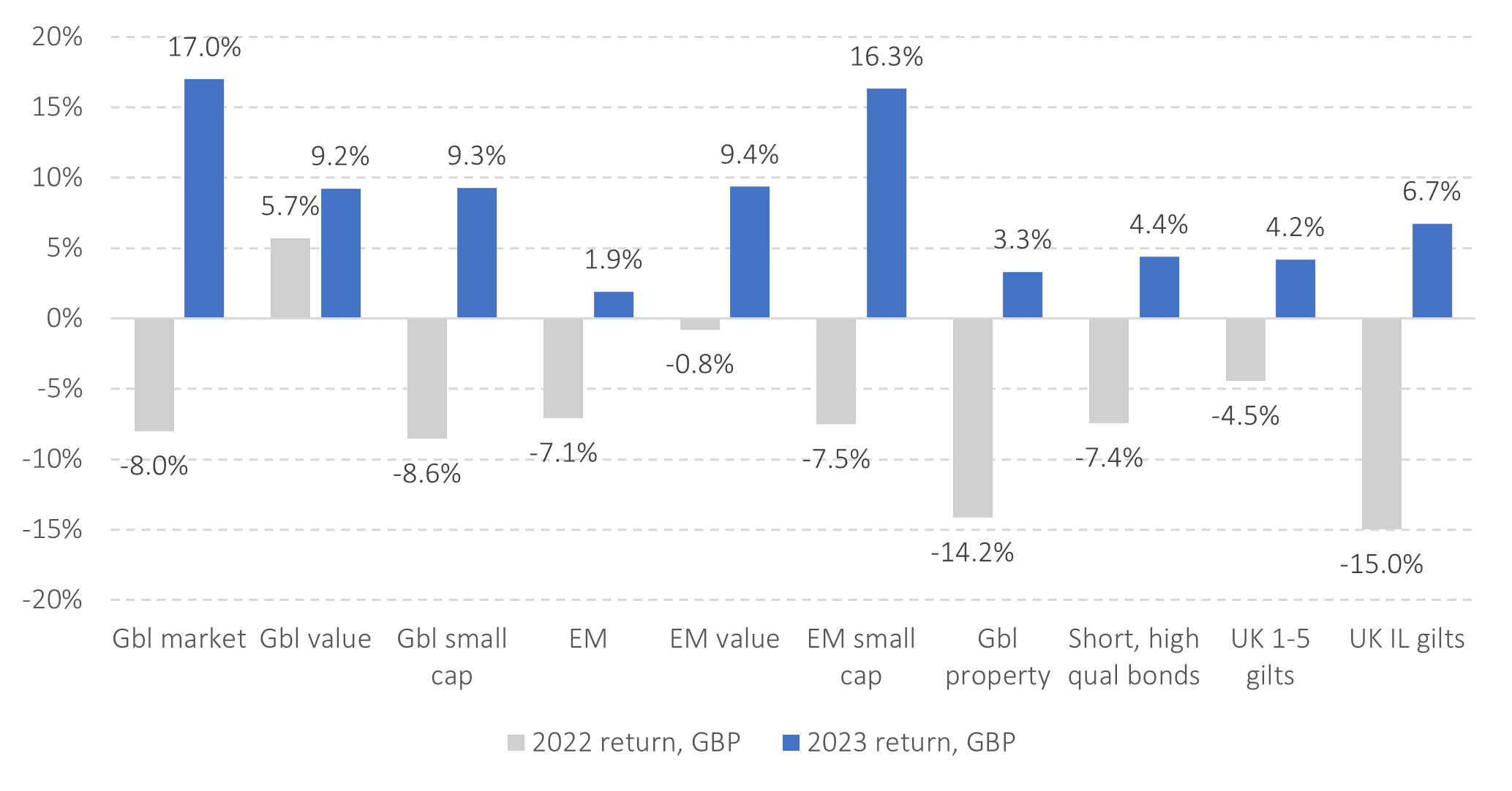

Last year all core assets delivered positive returns. The US market – and in particular the ‘Magnificent Seven’ as the press have dubbed the big tech firms – regained the losses they suffered in 2022. In fact, they contributed around three quarters of the return of the US market over the year. As a consequence, global developed market returns were very strong, given that the US weight in global markets is around 63%. Value companies underperformed in the US (largely because of the overwhelming impact of the ‘Magnificent Seven’) but made a strong contribution outside the US. Both value and smaller companies outperformed strongly in emerging markets. Global commercial property (REITs) also managed a positive return.

On the defensive side of portfolios, high quality, short-dated bonds have recouped over half of the falls suffered in 2022 – largely on account of the higher bond yields, which caused the pain in 2022 – delivering returns similar to cash.

Figure 1: Global investment returns – 2022 and 2023 compared

Data: Funds used to represent asset classes, in GBP. See endnote for details.

Data: Funds used to represent asset classes, in GBP. See endnote for details.

Sensible, systematic portfolios comprising a diversified ‘growth’ basket of equities – with tilts to value and smaller companies – paired with ‘defensive’ short dated high-quality bonds will have delivered robust returns in 2023, somewhere in the region of 9% for a 60/40 split respectively in GBP terms[1]. Investors with portfolios denominated in GBP suffered a small currency drag over the year as Sterling appreciated against the US Dollar by around 4%, as well as most other major currencies. Year-on-year inflation in the UK fell to 3.9% in November, down from 10.5% at the start of the year.

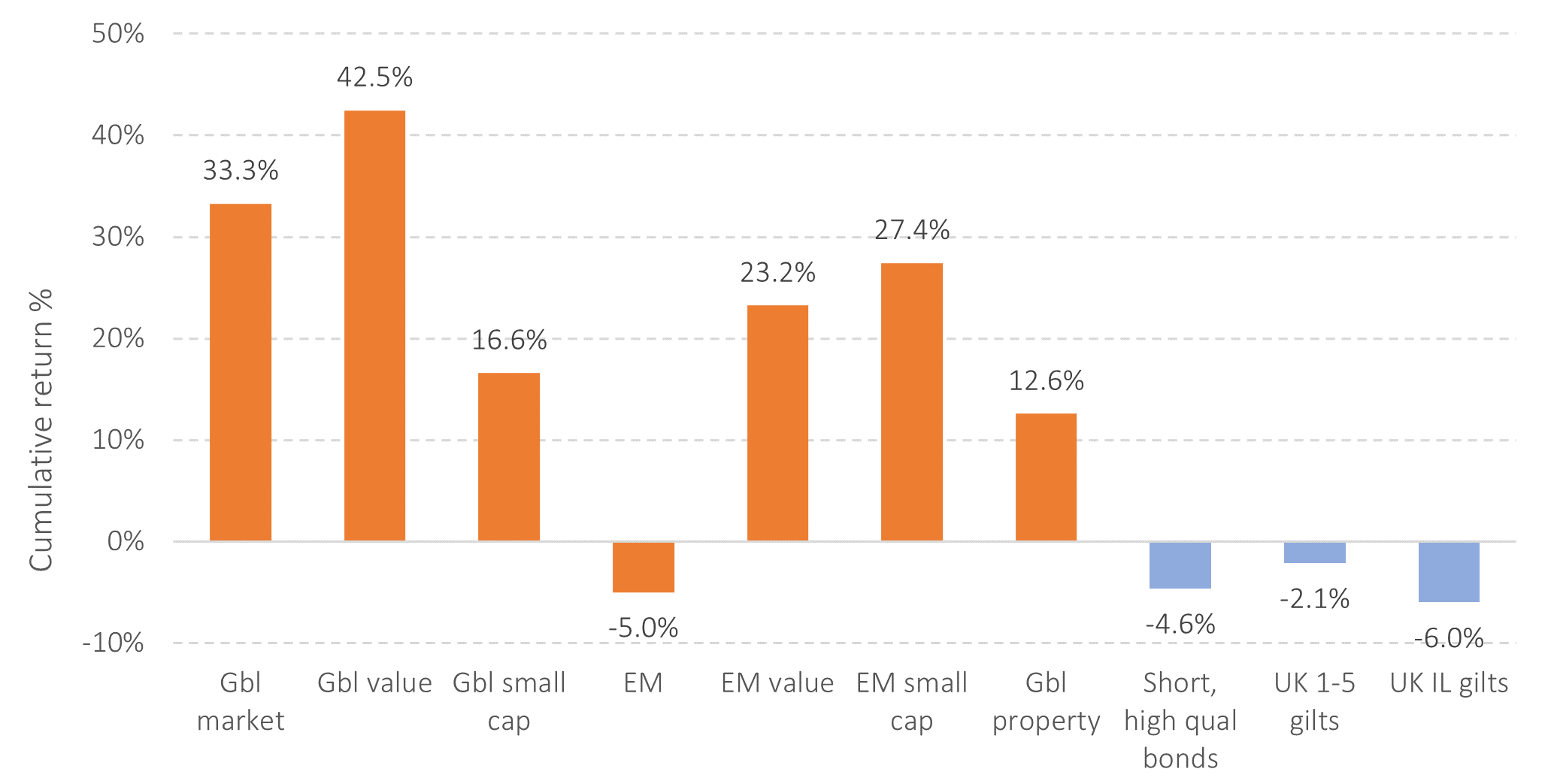

Looking at three-year cumulative returns helps to illustrate the benefit of remaining invested through tough years such as 2022. Bond returns have been poor due to starting yields around 0% at the start of the period followed by subsequent yield rises (and thus bond price falls), but these were more than compensated for by strong growth asset returns.

Figure 2: Cumulative global investment returns – three years to the end of 2023

Data: Funds used to represent asset classes, in GBP. See endnote for details.

Looking forwards

The outlook for the global economy looks a little bleak as major economies teeter on the brink of recession, including the UK. China has deep and wide economic problems that are restraining its growth prospects. Inflation has come down in the EU (2.4%), US (3.1%) and UK (3.9%) from recent double digit highs. Risks remain – including conflict in the Middle East impacting energy and supply chains – and the final yards to reach central bank target levels of inflation (2% in the UK) will be harder to achieve and vulnerable to geopolitical risks. Interest rates may well remain elevated relative to the low rates that investors experienced up until early 2022, which is good for bond holders.

It is useful to remember that forward-looking views are already reflected in today’s prices. What comes next, no-one truly knows. The key is to remain highly diversified, resolute in the face of any market setbacks and focused on long-term goals.

And finally…

More broadly, Putin continues to wage his illegal and brutal war in Ukraine and the terrible humanitarian tragedy unfolding in Gaza seems to have no resolution in sight. Our thoughts are with all the innocent people caught up in these conflicts.

This year we face the prospect of elections in democracies such as the UK, US, Taiwan, India, Pakistan, Indonesia, and within the European Union. US politics is as deeply partisan as it has ever been, raising the level of uncertainty about the future. The democratic process is always combative, often messy and sometimes ugly. Let us hope that these elections result in governments that fulfil Lincoln’s wish set out in his Gettysburg Address after the Battle of Gettysburg in 1863:

‘that these dead shall not have died in vain—that this nation, under God, shall have a new birth of freedom—and that government of the people, by the people, for the people, shall not perish from the earth.’

In the UK, it is certainly possible that the Conservatives will struggle to remain in government. As Churchill once said:

‘Many forms of Government have been tried and will be tried in this world of sin and woe. No one pretends that democracy is perfect or all-wise. Indeed it has been said that democracy is the worst form of Government except for all those other forms that have been tried from time to time…’

Winston S Churchill, 11 November 1947

On a brighter note, it is worth remembering that despite the conflicts in the world, seeming discourse in democratic nations and the rise of autocratic and despotic leaders, the world we live in is better in many respects than ever before. While 659 million of the world’s population live in poverty, this is down from 1.9 billion in 1990 and 902 million in 2012[2]. Global under-5 mortality has dropped by 60%, 2.1 billion people have gained access to safe drinking water since 2000 and today 40% of board seats in FTSE 350 companies are held by women (10 years ago 150 or so of these companies had no women on their boards)[3]. These lesser known facts are a strongly positive counterbalance to the immediate troubles that the world faces.

From an investing perspective, we remain hopeful for the best in 2024 but remain prepared for the worst, as is always prudent.

Happy New Year!

[1] Refer to table in the endnote for underlying funds and allocations. This is provided for informational insight only and does not represent any form of advice or recommendation.

[2] https://borgenproject.org/victories-fighting-poverty/

[3] Sunday Times magazine, December 31, 2023. ‘Really, actually, properly excellent things that happened in 2023’

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Data series used

| Asset class | Fund | ISIN | Weight in P60/40 |

| Gbl market | Fidelity Index World P Acc | GB00BJS8SJ34 | 27.5% |

| Gbl value | Dimensional Global Value GBP Acc | IE00B3NVPH21 | 9.2% |

| Gbl small cap | Vanguard Glb Small-Cp Idx £ Acc | IE00B3X1NT05 | 9.2% |

| EM | iShares Emerging Mkts Eq Idx (UK) D Acc | GB00B84DY642 | 4.9% |

| EM value | Dimensional Emerging Mkts Val GBP Acc | IE00B0HCGX34 | 1.6% |

| EM small cap | iShares MSCI EM Small Cap ETF USD Dist | IE00B3F81G20 | 1.6% |

| Gbl property | L&G Global Real Estate Div Index I Acc | GB00BYW7CN38 | 6.0% |

| Short, high qual bonds | Dimensional Global Short Dated Bd Acc | GB0033772848 | 36.0% |

| UK 1-5 gilts | iShares UK Gilts 0-5yr ETF GBP Dist | IE00B4WXJK79 | 0.0% |

| UK IL gilts | Dimensional £InflLnkdIntermDurFI GBP Acc | IE00B3PVQJ91 | 4.0% |

More information is available on request.

About the author

Albion Strategic

Albion were born in 2001 and initially focused on working with private banks and family offices in the US. In 2006, they began consulting to leading financial planning companies in the UK, many of which have grown into robust, successful and respected firms with strong regional brands.

In that same year, Smarter Investing was published and is now in its third edition. Their systematic approach to investing was tested in the Credit Crisis of 2008-9 and survived with honours. The Albion approach has also been shown to be robust in the more positive markets since, capturing the bulk of returns offered by the markets.

Theory, evidence, logic and patience are the key ingredients to investing success.