Advice and implementation

The aim of this stage is to produce an investment plan which will form the basis of your relationship with us.

-

Research

We will conduct detailed research on your current financial situation, including any existing plans you may have. The time taken for research will vary depending on your situation. If you have a large number of existing plans this will typically extend this period as we look to obtain the required information. Throughout this time you will be updated on progress by a member of your client team, who will also be able to answer any questions you may have.

Please note that while we review all your existing plans and take these into account in your planning we do not offer advice on Defined Benefit pension transfers. Advice on these types of transfers is offered as a separate stand-alone service.

Once the research is completed, we will construct our advice based on the information we obtained in regards to your existing plans and from you in the discovery process.

-

Advice

We will present and discuss with you the finalised investment plan. This will provide you with an opportunity to gain clarification on the plan and discuss any areas of concern. As well as our recommendations, the plan will also detail the particular risks and costs involved for the advice. We will leave you with a copy of the investment plan so you are able to review the recommendations at your leisure.

-

Implementation

Once you have confirmed that you understand and are happy with the plan, we will put your agreed strategy in place. This can be a lengthy process, depending on the complexity of your current position and our recommendations. Throughout this period, a member of your client team will provide regular updates on progress.

-

Review

The review meeting allows you to review the work that has taken place and ask any questions that may have arisen since our last meeting. It will provide the first chance to see what progress has been made in reaching your goals and objectives set out at the start of the process. This typically takes place 1-2 months after we’ve completed the implementation stage.

The completion of this stage is just the start of a long and rewarding relationship with you. From here, we hope you will engage with our ongoing service approach.

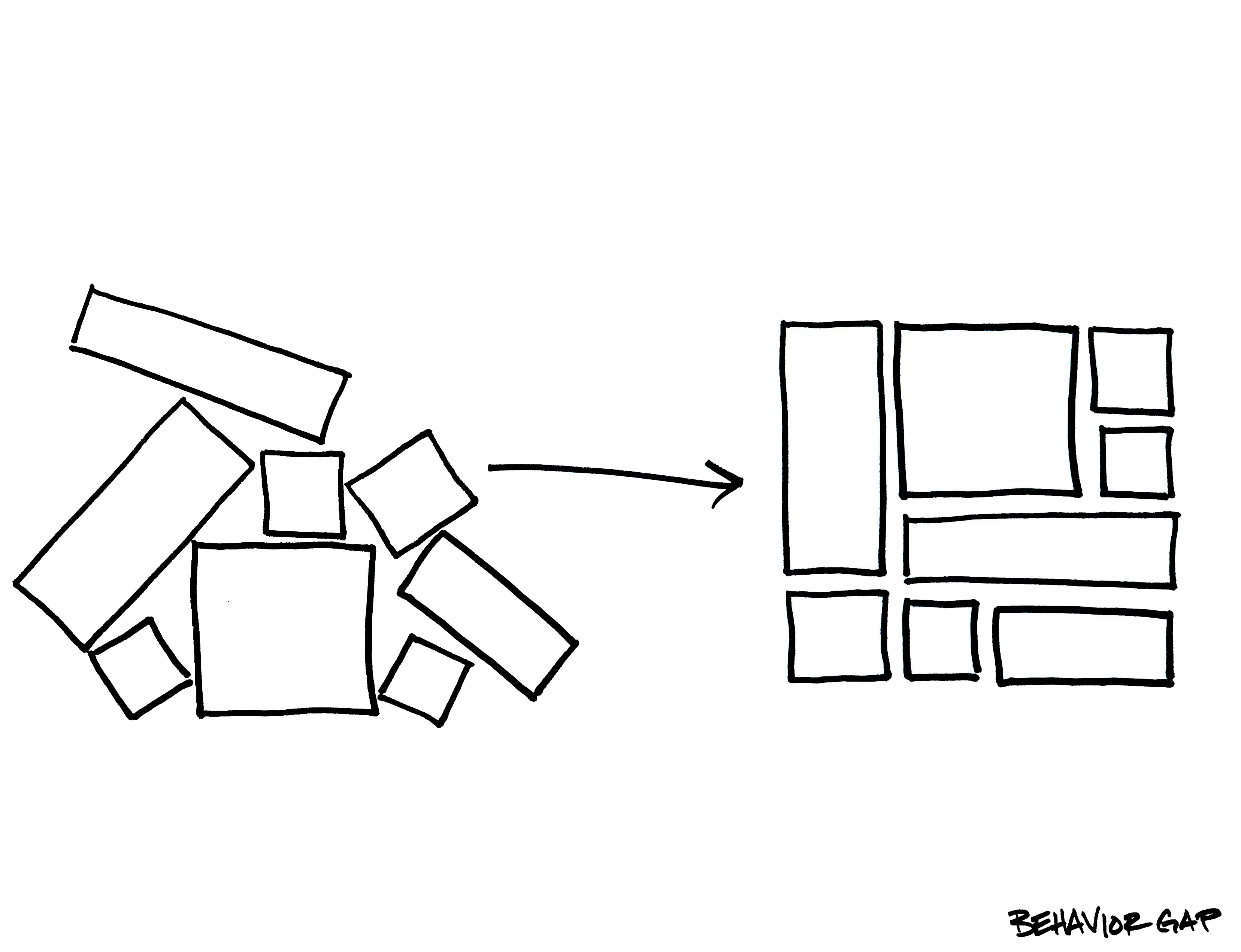

Portfolio design

Successful investing is about having a diverse range of investments and being prepared to invest for the long term.

Key to this is ensuring that you have a well-constructed portfolio of investments which covers a variety of asset classes, such as shares (equities), bonds (fixed interest stocks), real estate, cash and commodities. This will spread the risk of all of your investments falls. However, your financial planner will ensure that your portfolio is appropriate for the amount of risk you are willing and able to take.