Charging philosophy

Our charging philosophy

Satis believe fees should be simple to understand, easy to administer, and transparent at all times.

We charge fees for the professional service which we provide to you. We hope that you will always find value in these fees, either through reduced costs, improved service, a release of your time, or the simple pleasure of having clarity and confidence in your finances.

Our fees

Our fees reflect the skills, time and resources needed to provide you with a professional service that is personal to you and your family’s plans. They also reflect our desire and need to make a profit. Profitability, and therefore the likelihood of remaining in business, is a key criterion we have when selecting products and investments to recommend to you. We suggest it should also be part of your criteria when choosing a wealth manager.

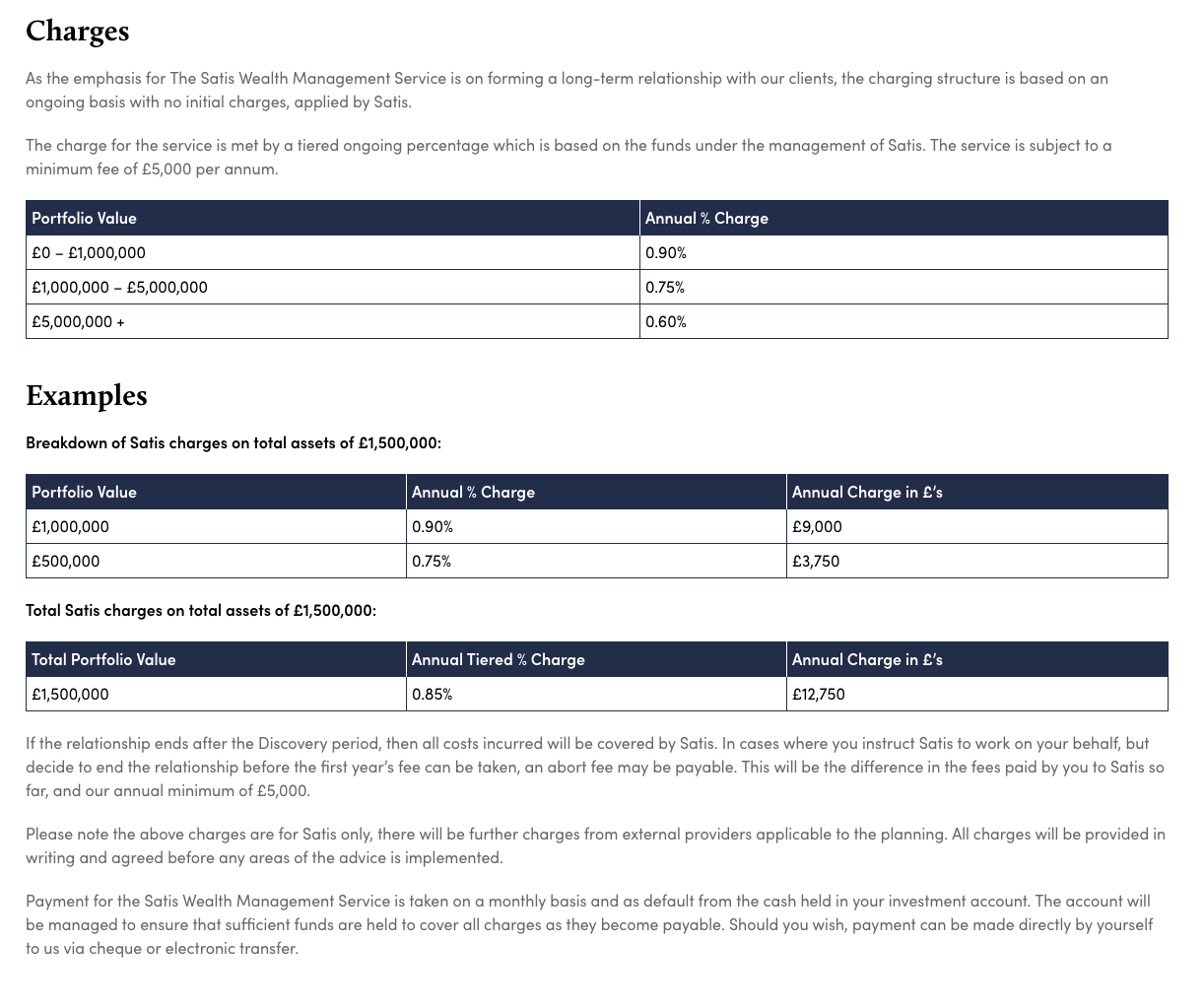

We do not currently charge any initial fees, implementation fees, transfer fees, switching fees or withdrawal fees.

We simply charge an ongoing annual management fee to cover our ongoing work for you. The fee is based on the value of the assets we manage for you. It is subject to a minimum charge, to cover the costs of our wealth management service, whether we are managing your investments or not.

As independent financial advisers, we may recommend products and providers from the whole of the market. The fees they will charge you are important criteria in our decision to recommend them to you.

Satis will always provide you with an estimate of all fees before we start work, and will always request your written authorisation before we start charging any fees.

For an example of how our fees work in practice, please click on this link.

For an example of how our fees work in practice, please click on this link.

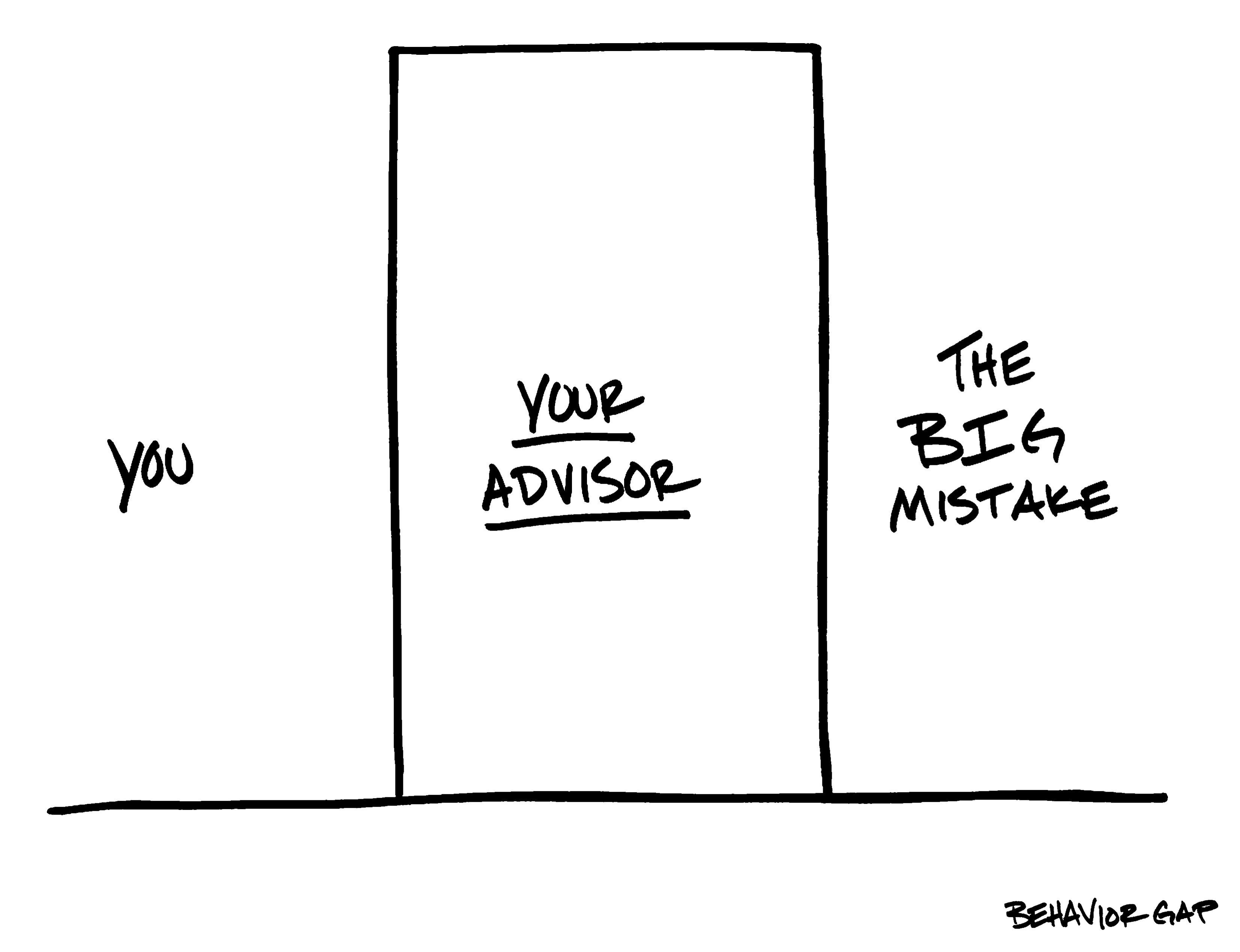

The value of a financial planner

There are many studies which show that investors perform better when they partner with a financial planner. The role of the planner is not just to help you make decisions on asset allocation, diversification and retirement vehicles; but also, to ensure that your investments are working in tandem with your financial plan. With their knowledge of you and your investments, discipline and dedication, good planners will prevent you from making ‘the big mistake’.