Planning philosophy

Our planning philosophy

The planning philosophy of Satis is based on discovery, clarity and an ongoing relationship.

We believe the planning process should be personal and enjoyable. Whilst we will focus on uncovering your financial information in our discovery process, we will also find out about your values, principles, family, interests and hobbies. This makes the process more enjoyable for you as you can see that you are working towards achieving the goals that matter to you. It also helps to provide us with valuable planning information which you may not have thought relevant previously.

Throughout the process, we aim to be clear and understandable. This starts with our engagement documents which have been written with clarity in mind, through to our Investment Plan, which serves as the basis for our ongoing relationship. At all stages, it is vital that you understand the advice being provided and we will always make sure this is the case before we implement any advice given.

The implementation of your investment plan is the start, not the end, of your wealth planning relationship with Satis. It is vital to continue to meet and discuss your planning requirements as these will often change throughout your relationship with Satis. As part of this ongoing relationship, Satis will not only work closely with you, but will also work closely with any of your other expert advisers such as accountants, solicitors, attorneys, architects and anyone else required to make sure all of your financial affairs are being managed in a sensible, cohesive way.

By following this process, Satis believe we can deliver significant financial and emotional benefits for you.

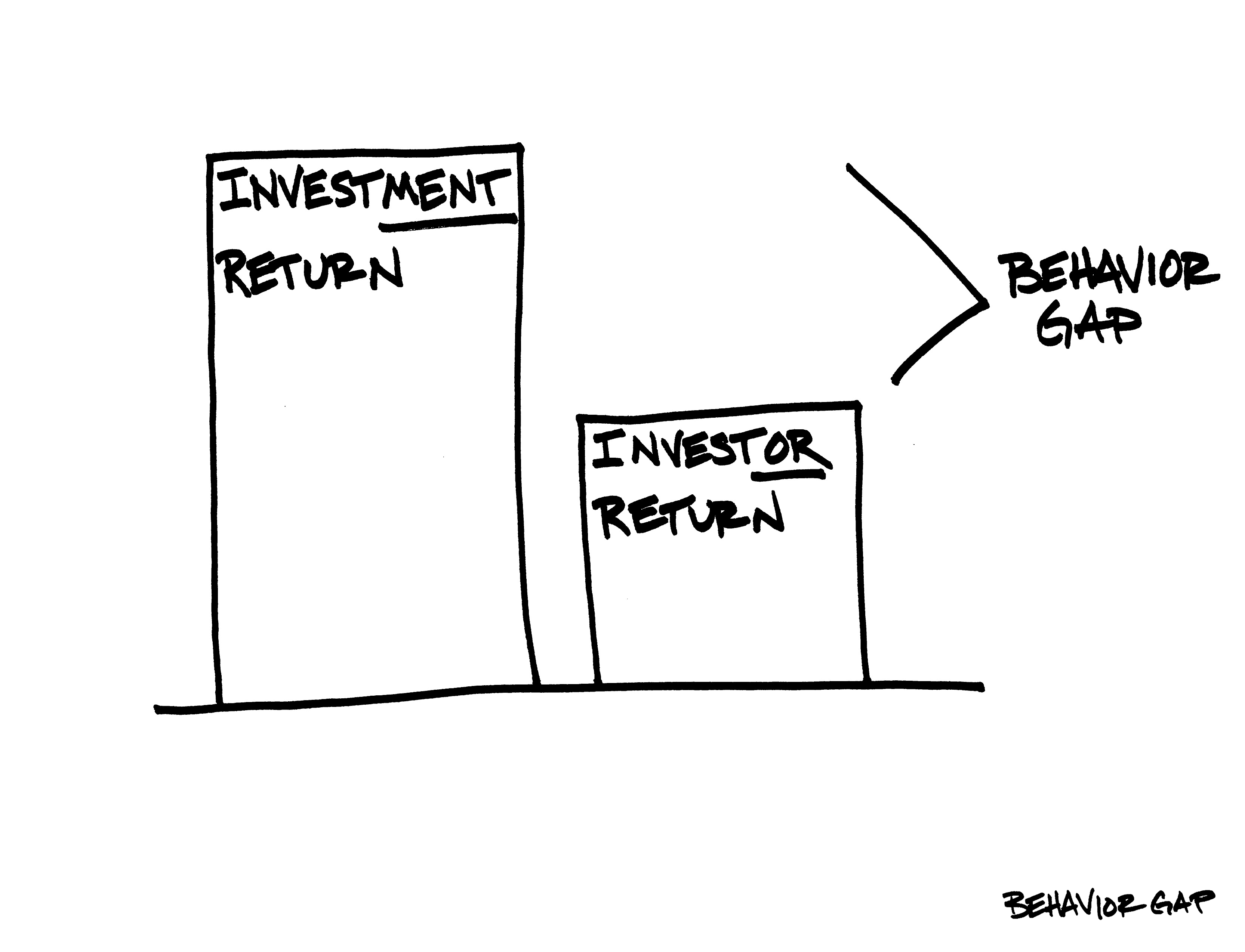

The behaviour gap

The investment return is the rate at which an investment grows in value over a period of time. It is based on the assumption that you invest a lump sum at the beginning of the period, and then you leave it alone. However, the investor return (or what the investor receives from their investment) is often far lower. Why? Because of investor behaviour. By not holding onto their investment over the long term, they receive a lower return when they sell. Evidence shows that those who hold on to their investments have been more successful than those who try to ‘time the market’ by buying stocks at a low price and selling at a high price.