Hopefully, the headline of this note will not come as a surprise to you. It is remarkable, though, just how relaxed some investors are about letting others dip their hands in their pockets to extract high fees. The problem has two root causes. The first is that in most walks of life, paying higher costs should help you to secure the best lawyer, architect or builder, yet when it comes to investing, this relationship breaks down. The second is that costs of, say 1% p.a. do not seem like very much, but unfortunately they are when compounded over time as we shall see.

Unfortunately, the vast majority of active managers, who promise to beat the market, fail to deliver on that promise[1]. High costs are a contributory factor to this failure. Surprisingly to some, picking funds by their costs is one of the few useful metrics available to us. Research by Morningstar – a firm that makes a living providing star ratings for mutual funds – confirms this:

‘If there’s anything in the whole world of mutual funds that you can take to the bank, it is that expense ratios [i.e. ongoing charges figure or OCF] help you make a better decision. In every single time period and data point tested, low-cost funds beat high-cost funds.’

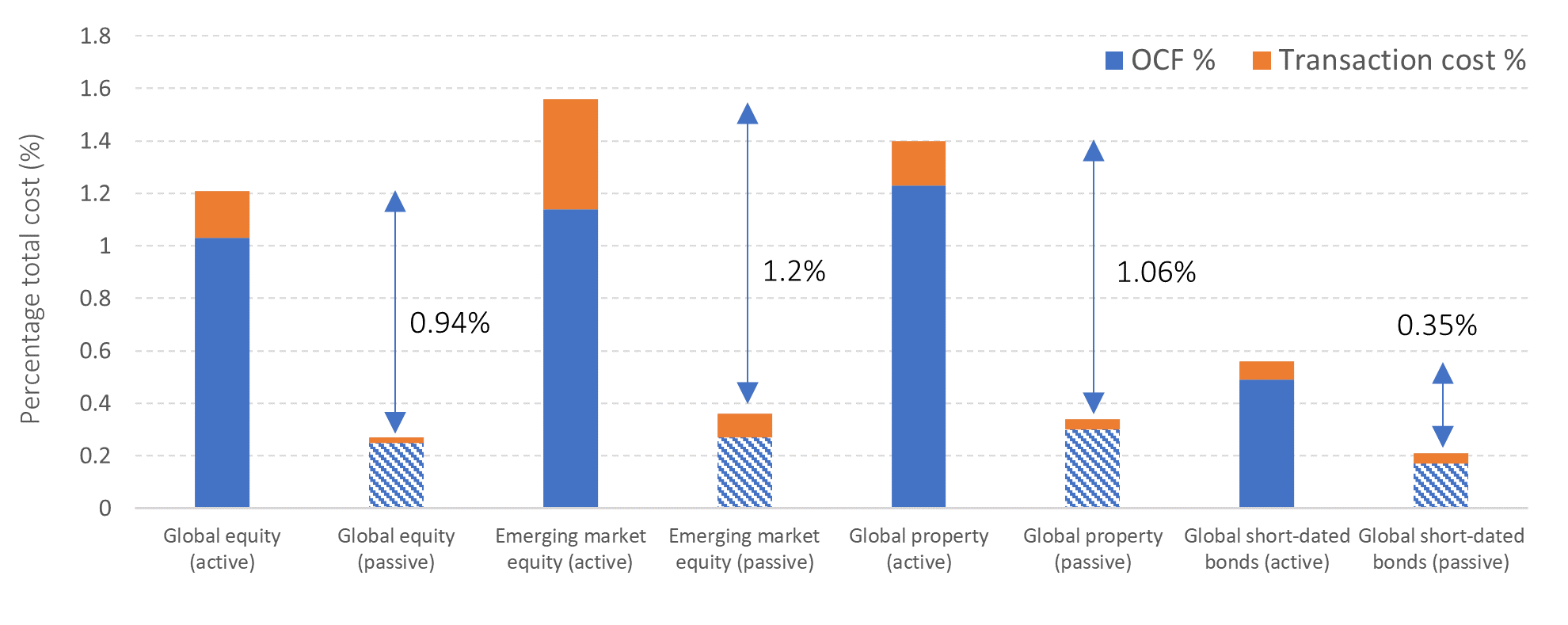

A recent piece of research on US mutual funds[2] reveals that the relentless drag of costs makes a meaningful difference to investor outcomes. It ranked equity funds – over 20 years to the end of 2021 – into low and high-cost quartiles, of those with the lowest costs (0.84% p.a.) 31% were ‘winners’ (i.e. beat the benchmark) and of those with high costs (1.75% p.a.) only 6% were ‘winners’. Similar results were observed when funds were ranked by trading costs (incurred through buying and selling). In the UK, there is still a big gap between the ongoing charges figure (OCF) of active and passive (index) funds, and also reported trading costs, which recent research from Albion (2022) reveals. This is illustrated in the figure below, showing average fund costs.

Figure 1: Average active and passive (index) fund costs in the UK (end September 2022)

Source: Albion Strategic Consulting – Governance Update 24. Fund data from Morningstar Direct © All rights reserved.

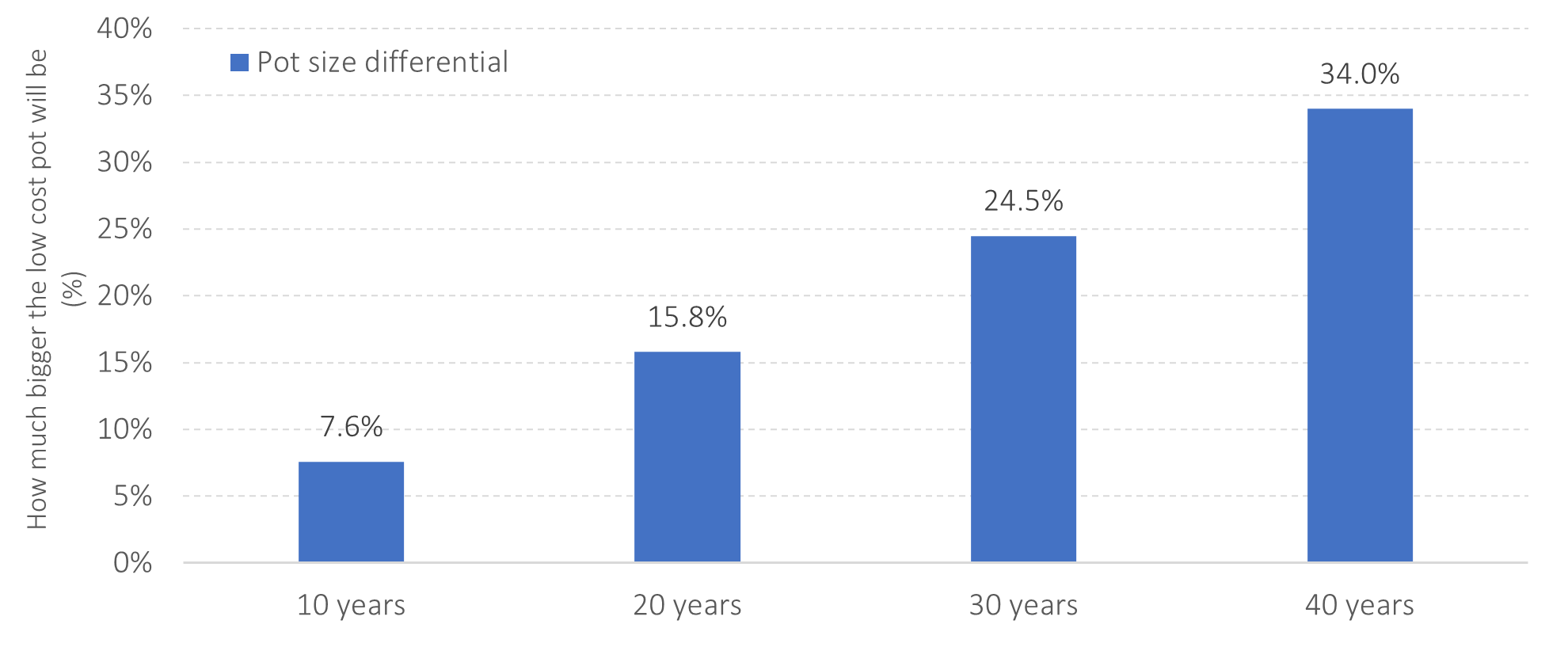

If we construct a simple illustrative portfolio[3] with 48% in global equities, 6% in emerging market equities, 6% in global property REITs and 40% in global short-dated bonds, the portfolio level fees are 0.98% for the ‘high cost’ active fund version and 0.26% for the ‘low cost’ passive (index) fund version. With some straightforward maths[4], we can calculate the difference in wealth outcomes of investing in these two cost strategies over different time horizons. For the purposes of this exercise, we will assume that the two strategies earn the same return, which is favourable to the active funds, as most deliver a return lower than the market1.

Figure 2: How much bigger your pot would be by using the lower cost strategy

Source: Albion Strategic Consulting

Advisers who adopt a systematic evidence-based approach to investing take costs seriously on their clients’ behalf. John C. Bogle, the late founder of Vanguard and investment legend drew a powerful conclusion that investors should take note of.

‘The grim irony of investing is that we investors as a group not only don’t get what we pay for, we get precisely what we don’t pay for.’

No wonder one of his favourite sayings was:

‘Cost matter!’

[1] Numerous studies including SPIVA® reports across several markets and time frames.

[2] Dimensional Fund Advisers: The Fund Landscape Report 2022

[3] This is provided for information and educational purposes. It does not constitute any form of advice. For illustrative purposes only.

[4] We use Professor William Sharpe’s return ratio = [(1-low cost %)/(1-high cost %)]^number of years.

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

About the author

Albion Strategic

Albion were born in 2001 and initially focused on working with private banks and family offices in the US. In 2006, it began consulting to leading financial planning companies in the UK, many of which have grown into robust, successful and respected firms with strong regional brands.

In that same year, Smarter Investing was published and is now in its third edition. Their systematic approach to investing was tested in the Credit Crisis of 2008-9 and survived with honours. The Albion approach has also been shown to be robust in the more positive markets since, capturing the bulk of returns offered by the markets.

Theory, evidence, logic and patience are the key ingredients to investing success.