Performance comes, performance goes. Fees never falter.

Warren Buffett, investment legend, Chairman, Berkshire Hathaway (2018 Letter to Shareholders)

Costs, time and compounding are an insidious mix

It is a shame that human beings are so poorly wired to be good investors. We have many deep-seated biases and behaviours that, whilst once useful to survive in the wild, do us a great disservice when investing. One area of weakness is our poor grasp of the exponential impact of compounding that can work both for and against us.

Imagine three different portfolios that deliver returns of 1%, 3% and 5% per year after inflation, but before other costs, over a period of 30 years: £100,000 invested in each would result in a growth of purchasing power to around £135,000, £240,000 and £430,000 respectively. Seemingly small differences in the compound rates of return (geometric returns), turn into large differences, in terms of financial outcomes. That’s one of the great positives of a disciplined and patient approach to investing – small returns turn into big numbers, given time.

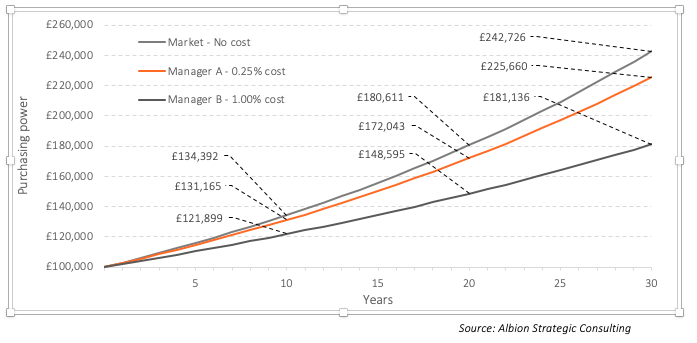

On the other side of the coin, costs – when compounded over time – eat away at these market returns to a far greater degree than many investors ever imagine. Let’s compare two managers who deliver 3% gross (before fees) above inflation, where Manager A has costs of 0.25% and Manager B has costs of 1.00%. We plot the purchasing power impact of these different fee strategies on outcomes, across time, in the chart below. As you can see, costs matter a great deal; an investor in Manager B’s fund is over £40,000 worse off than an investor with Manager A’s fund over 30 years. Put another way, you end up one third more wealthy selecting Manager A over Manager B.

Figure 1: Compounding is a powerful concept *1

*1 Compounding: Starting amount X ((1+rate of return)^number of years), where ^ is ‘to the power of’.

As Jack Bogle would say: ‘In investing, you get what you don’t pay for’. A pound of costs saved is more valuable than a pound of performance gained because you reliably get its benefits every year.

Notes and risk warnings

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.