One of the great challenges that all investors face is that there is no easy or quick way to investment success. Aesop’s fable of the tortoise and the hare is a useful metaphor. You have to use the time on your side – which could be over multiple decades – to capture the returns of the markets effectively, but often slowly.

In the short-term, market returns can be disappointing. The longer you can hold for, the more likely the returns you receive will be at worst survivable, and hopefully far more palatable. It is time that allows small returns to compound into large differences in outcome for the patient investor. The reality is that markets go up and down with regular monotony.

The stock market is a device for transferring money from the impatient to the patient.

Warren Buffett

If you want to be a good investor, you have to be patient. On your investing journey, you will spend a lot of time going backwards, recovering from the set back and then surging forward again, often in short, sharp bursts of upward market movement. You just have to stick with it. Remember that you have to be in the markets to capture their returns. Impatient investors tend to lose faith in their investments too quickly, often with painful consequences.

There are no certainties in investing, but investors can give themselves the best chance of achieving their expectations by allowing the passage of time to let short term uncertainty be overwhelmed by long term expected outcomes.

In the short run, the market is a voting machine but in the long run, it is a weighing machine.

Benjamin Graham

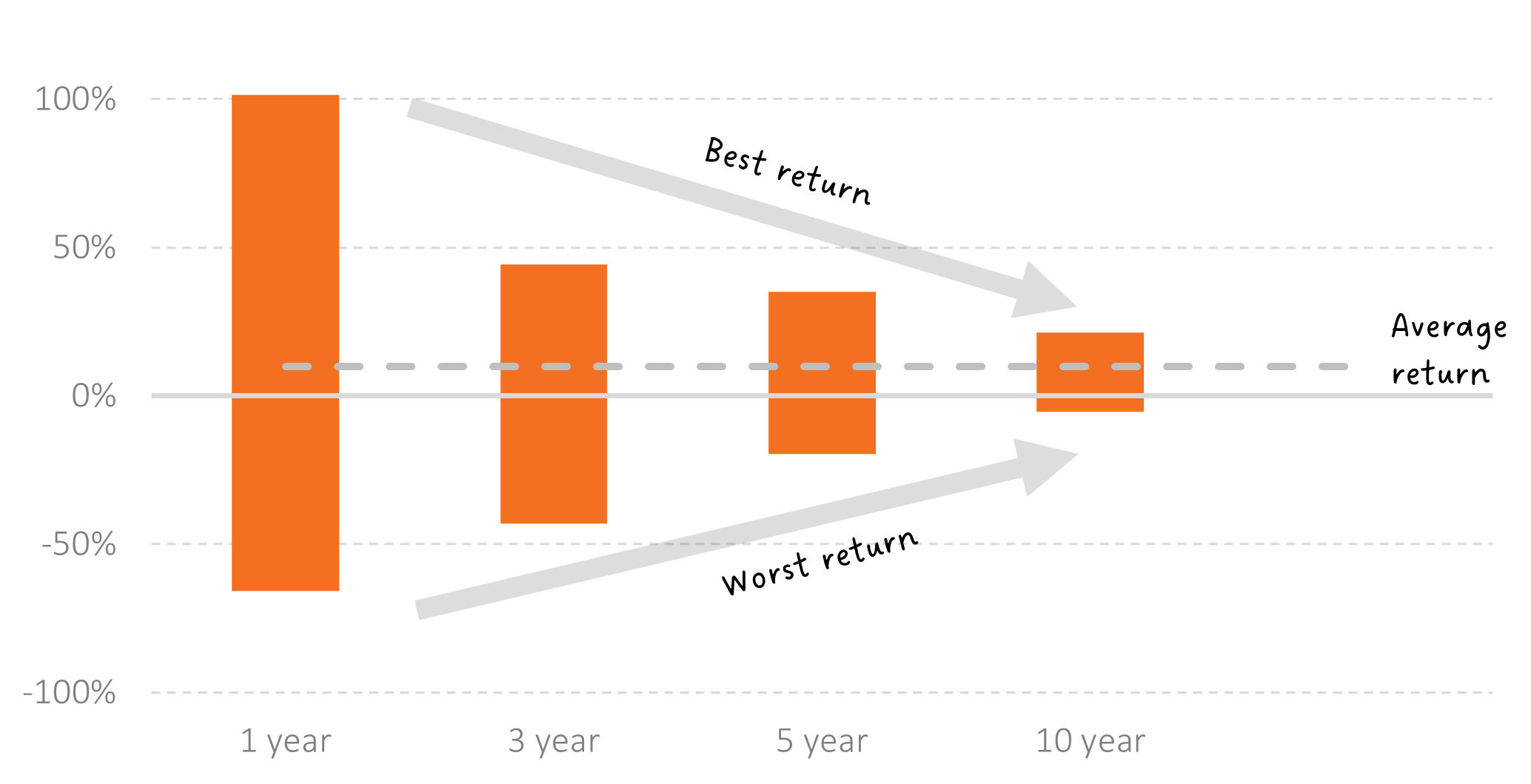

The figure below is a powerful graphic demonstrating the benefit of convergence towards stock market expectations enjoyed by investors who befriend time.

Figure 1: Converging stock market outcomes as holding period increases, Jul-1926 to Jul-2024

Source: Albion Strategic Consulting. Periods on an annualised, monthly rolling basis. Omits ‘Best return’ outcomes for 1 year to May-33 and Jun-33 due to axis limitation. See endnote for details on data used.

Risk warnings

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points and does not constitute any form or recommendation or advice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Data used

Albion World Stock Market Index: Jul-26 to Dec-74 – Fama/French Total US Market Research Index. Jan-75 to Jun-89 – 40% Fama/French International market Index, 60% Fama/French Total US Market Research Index. Jul-89 to Jun-08 – 5% Fama/French Emerging Markets Index, 65% Fama/French International market Index, 30% Fama/French Total US Market Research Index. Jul-08 to present – Vanguard Total World Stock Index I VTWIX. Data in nominal terms and presented in USD.

About the author

Albion Strategic

Albion were born in 2001 and initially focused on working with private banks and family offices in the US. In 2006, they began consulting to leading financial planning companies in the UK, many of which have grown into robust, successful and respected firms with strong regional brands.

In that same year, Smarter Investing was published and is now in its third edition. Their systematic approach to investing was tested in the Credit Crisis of 2008-9 and survived with honours. The Albion approach has also been shown to be robust in the more positive markets since, capturing the bulk of returns offered by the markets.

Theory, evidence, logic and patience are the key ingredients to investing success.