The investment management industry loves its legends and there are none bigger than the nonagenarian ‘Oracle of Omaha’ Warren Buffett, CEO of the US-listed firm Berkshire Hathaway. Over the years in that role Buffett has built a portfolio of directly held companies alongside a portfolio of listed stocks. Today, he is worth over US$100 billion and is the world’s fifth wealthiest person. In anyone’s eyes, he is a highly successful investor and is often held up as a beacon in support of an active, judgmental approach to investing.

Paradoxically, Warren Buffett’s legendary status as an active investor provides some useful lessons in support of adopting a systematic, low-cost approach to investing.

Lesson 1: believe in the power of capitalism and compounding over time

Buffet understands capitalism and the powerful wealth generation that it can bring. He started investing in 1941 when he was 11 years old, and now at 92 years old, has over 80 years of compounding returns from the predominantly US companies he has owned. By the age of 39 he was worth US$25 million. His life story is fascinating[1].

‘The genius of the American economy, our emphasis on a meritocracy and a market system and a rule of law has enabled generation after generation to live better than their parents did.’

Lesson 2: patience and emotional fortitude are key

Buffett expects to hold the companies for the long-term, much like an index fund.

‘Our favorite holding period is forever.’

He strives to avoid making decisions driven by emotions in response to short-term market pressures, such as the poor relative performance of value stocks from 2018-20 or equity market falls.

‘The most important quality for an investor is temperament, not intellect.’

Lesson 3: active management is not easy

Despite his incredible business acumen, and consequent track record, it is not easy to continue to beat the market over time. He has always been a value oriented investor and was notorious in the run up to the tech crash of 2000-3, stating that he did not get it. He was to some extent proved right. As Berkshire has grown, finding deals that will make a material difference to performance has become harder. His early years were spent trawling for individual investment opportunities. In those post-war years, information was scarce, professional investors represented a far lower part of the investor base, and markets were probably less efficient. If he was starting out again, would he be as successful? Who knows? And there’s the rub.

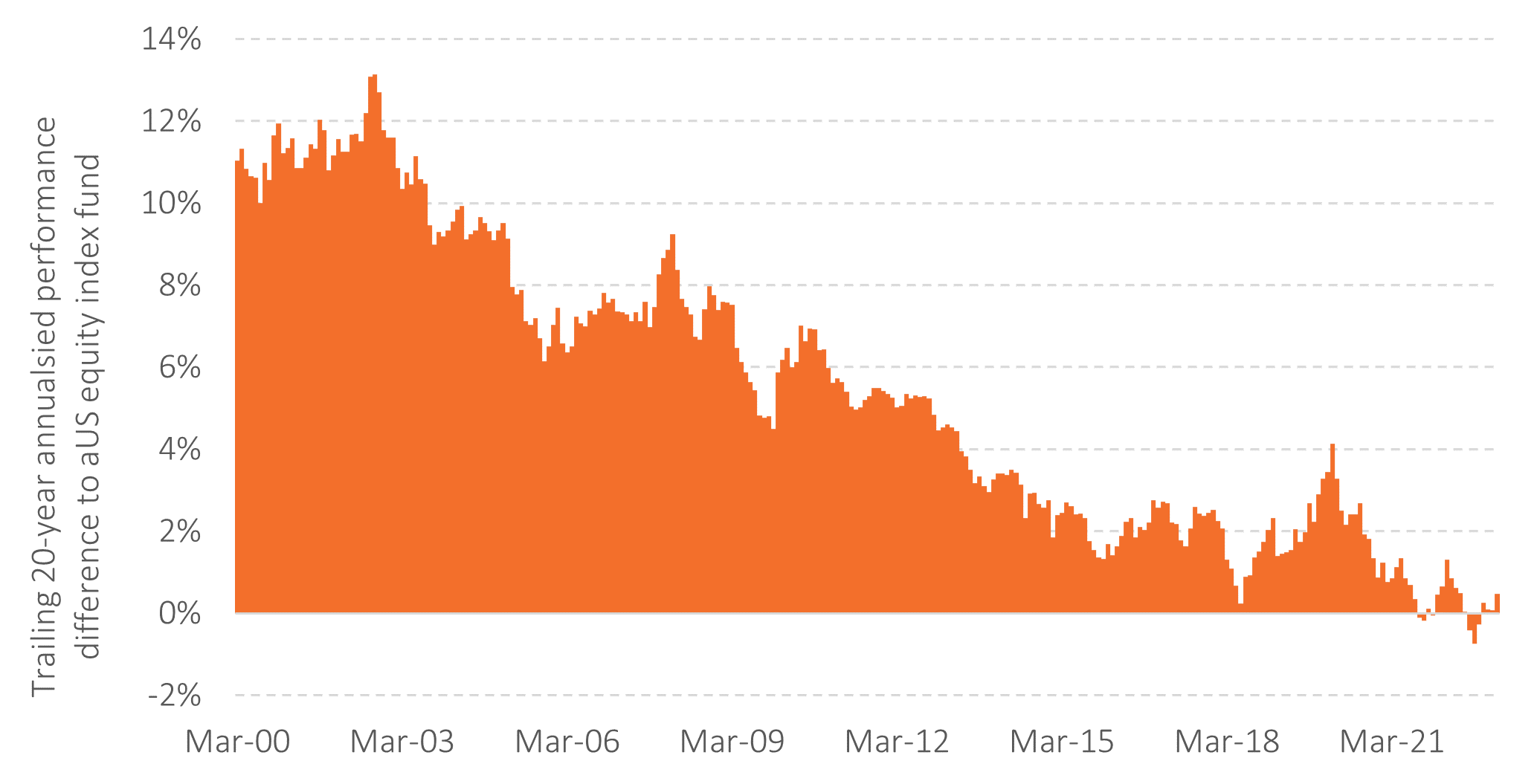

Take a look at the chart below, which illustrates 20-year rolling windows of Berkshire’s performance relative to a US equity index fund. It is evident that the huge success of the early days, has given way to far more trying times. Over the past 20 years, you could have achieved virtually the same return by investing in an S&P 500 index fund.

Figure 1: Buffet’s alpha – it is not so easy to win anymore

Source: Berkshire Hathaway Inc Class A, Vanguard 500 Index Investor Fund (VFINX) USD. Morningstar Direct © (see endnote)

Lesson 4: you need an investment approach for your lifetime

Warren Buffett may be a legend, but he is not immortal. At 92, Warren Buffett’s reign at Berkshire is in a late innings. Will his successor be able to deliver market beating returns? What impact will Berkshire’s concentrated, sector-skewed and US centric portfolio of companies have on performance? Will it miss out on some of the – as yet unknown – global winners of the future? You can simply avoid this dilemma by owning a well-diversified index fund. Buffett agrees.

‘The goal of the nonprofessional should not be to pick winners – neither he nor his ‘helpers’ can do that – but should rather be to own a cross section of businesses that in aggregate are bound to do well.’

‘Consistently buy an S&P 500 low-cost index fund. I think it’s the thing that makes the most sense practically all of the time.’

Lesson 5: humility and using wealth well

His legendary status also relates to his humility as a person and his humble lifestyle. No superyachts, private jets, multiple homes and international staff for him. He lives in the same house he bought in 1958 in Nebraska, eats McDonald’s burgers, sucks on See’s Candies and famously drinks Coke. He intends to give away all of his wealth when he dies, of which 85% will be passed to the Bill and Melinda Gates Foundation. He explained:

‘I don’t have a use for the money. It just makes you feel good to do it.’

Perhaps that is his greatest lesson of all.

[1] Read this article if you are interested. https://www.thebalancemoney.com/warren-buffett-timeline-356439

Risk warnings

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

![]()

About the author

Albion Strategic

Albion were born in 2001 and initially focused on working with private banks and family offices in the US. In 2006, they began consulting to leading financial planning companies in the UK, many of which have grown into robust, successful and respected firms with strong regional brands.

In that same year, Smarter Investing was published and is now in its third edition. Their systematic approach to investing was tested in the Credit Crisis of 2008-9 and survived with honours. The Albion approach has also been shown to be robust in the more positive markets since, capturing the bulk of returns offered by the markets.

Theory, evidence, logic and patience are the key ingredients to investing success.