It feels like 2024 is the year of the election with over 64 happening in various countries around the world covering around 50% of the world’s population[1]! These range from the farcical pretence of the re-election of Putin, to that in the UK. Currently, it looks like a probable victory for the Labour party over the incumbent Conservatives, seemingly with a large majority. In the previous election in 2019, British politics was polarised between Boris Johnson’s ‘getting Brexit done’ mantra and a very left-wing alternative of Jeremy Corbyn and his ‘magic money tree’. Today, the two main parties are vying for far more central ground that tends to win elections. Who said democracy does not work? In India, the world’s largest democracy, the people have spoken and have put a dent in the BJP and Modi’s ambitions of an overwhelming 400 seats. They gained just 240 instead, without a majority. The EU Parliament elections are due to begin, with concerns over the growing impact of the far-right. Throw in the US election chaos in November and investors might wonder how to process all of this in terms of what might happen to their portfolio.

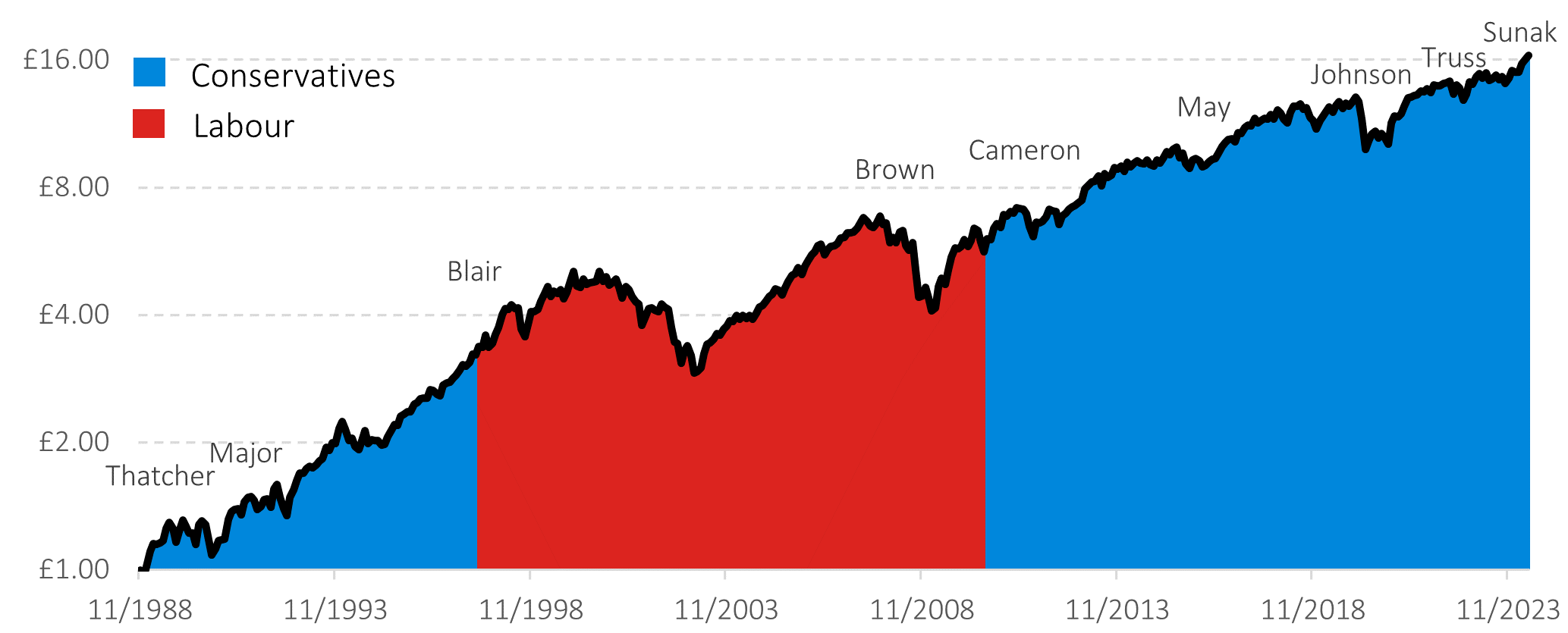

Well, the good news is that the markets have done this already for you! It is no doubt, for example, pricing in the probability of a Labour government and what it thinks about its policies, as far as they are known. That is what markets do. They incorporate all public information into prices quickly and efficiently, meaning that prices only move on the release of new information, which is random. The stock market tends to be resilient for those with the patience to sit out any passing market storms. It seems to be obligatory at these times to roll out a chart with the colours of the different parties indicating the periods they are in power – say in red for Labour and blue for Conservative – and showing the growth of the market. It does not tell you much, apart from these events have little impact, as the market prices in events well before they happen, so here it is:

Figure 1: The UK market’s growth of wealth over time, irrespective of who is in power.

Source: Albion Strategic Consulting. Data: CT FTSE All-Share Tracker 1 Inc (GB0008464199) from 01/10/1988, Vanguard FTSE UK All Shr Idx Unit Tr£Acc (GB00B3X7QG63) from 01/01/2010. Not a recommendation. Data in GBP in nominal terms. Election results data from House of Commons Library.

It really is pointless to try to predict an outcome any different to that already reflected in today’s market prices. What is your thesis? How have you interpreted the information that you have to hand? How is your view different to everyone else who is thinking similar thoughts? The reality is that it is really hard to outguess the market view reflected in prices.

As you can see from the figure above, these periods of political power are plotted against the UK market. But what does that tell you? Over 80% of the earnings of the UK market come from overseas, so how meaningful is it to just look at UK politics. Not only that, but the UK is likely to represent only a fraction of your global portfolio, as it only represents around 4% of total world market capitalisation. So, you will need to factor in all 64 elections, all other world events known and as yet unknown and decide how to position your portfolio accordingly.

Alternatively, you could be patient, trust that the markets work pretty well and reflect the aggregate view of all investors and believe in the power of capitalism to deliver rewards due to you as the part owner of companies (equities) and as a lender (bonds). We advise the latter approach.

The most important thing you can do is vote.

[1] TIME (2023) The Ultimate Election Year: All the Elections Around the World in 2024. https://time.com/

Risk warnings

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points and does not constitute any form or recommendation or advice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

About the author

Albion Strategic

Albion were born in 2001 and initially focused on working with private banks and family offices in the US. In 2006, they began consulting to leading financial planning companies in the UK, many of which have grown into robust, successful and respected firms with strong regional brands. In that same year, Smarter Investing was published and is now in its third edition. Their systematic approach to investing was tested in the Credit Crisis of 2008-9 and survived with honours. The Albion approach has also been shown to be robust in the more positive markets since, capturing the bulk of returns offered by the markets.

Theory, evidence, logic and patience are the key ingredients to investing success.

Article image: https://bit.ly/3x5flsT