In my last note to you I optimistically stated that we would gently start to increase the numbers working in our London office. The good news is we did, the bad news is, it lasted two weeks.

In light of recent developments, once again we have reverted to the majority working from home to ensure the safety of our staff.

We are now used to this and it works well, most of our meetings will continue to be via video conferencing or telephone. However, our offices are not closed and if you require a face to face meeting these can still be arranged with the right amount of caution. I am sorry if you have had difficulty contacting us by telephone. The software that controls the diversion of our telephone lines is being upgraded in the next few weeks.

While we will maintain a presence in the London office and post is being received there, I ask that you continue to check with a member of the Satis Team if you need to send anything to us. A vast majority of the time an email will be sufficient and quicker, where it is not we can confirm the best course of action. As always when sending information please be vigilant, criminals continue to use the current circumstances for their benefit. Only send information to verified contact details supplied to you by a member of the Satis team.

Speaking of the Satis team, I would like to take this opportunity to welcome two new members to the team. Sannie Cristina Fox has joined us on a permanent basis as an administration assistant after a temporary period as a receptionist, while Hitesh Jogia has joined the firm as a Financial Planner. Hitesh has extensive experience in the financial services industry working with a variety of different types of Satis calibre clients including entrepreneurs, senior executives and partners in professional service firms. He has achieved the status of Chartered Financial Planner. He will be working closely with the whole Satis team and David Hearne in particular. Over the course of the coming months I hope many of you will have the chance to speak to both Sannie and Hitesh.

To introduce himself further Hitesh is now taking over this update from me with his thoughts on the recent reduction in NS&I interest rates.

NS&I REDUCES INTEREST RATES – 5 KEY CONSIDERATIONS

National Savings & Investments (NS&I) has been an important component as part of simplifying our clients’ financial arrangements. Since 2008 we have lived in an environment of low interest rates lagging behind the pace of inflation and concerns still arise over the safety of entrusting banking institutions with savings. Currently over 21 million savers use NS&I to hold cash savings with around £88bn held in premium bonds in the hope they win a £1million jackpot with other tax free prizes starting from £25.

The news that NS&I have recently decided to dramatically reduce their rates on interest paid on savings accounts will come as a concern to many savers and investors. Before you press the panic/ fear button, let us have a look at the headline changes:

| NS&I ACCOUNT | CURRENT RATE | NEW RATE (GROSS) |

| DIRECT SAVER | 1.00% | 0.15% |

| INCOME BONDS | 1.16% | 0.01% |

| INVESTMENT ACC | 0.80% | 0.01% |

| DIRECT ISA | 0.90% | 0.10% |

| JUNIOR ISA | 3.25% | 1.50 |

It can appear as all doom and gloom, but it is important to place things into perspective. Here are five considerations:

1. Look on the Brightside.

Any reduction in interest rates is disappointing, but let’s not forget the Bank of England base rate is 0.10% and so the fact they remained high for so long should be seen as positive.

2. Cash creates a level of certainty.

There are many institutions offering headline savings rates, but are they really secure? Savings in NS&I is 100% protected by HM Treasury unlike a provider with a banking licence where only a maximum £85,000 per person is protected by the Financial Services Compensation Scheme.

Opening accounts with many different providers to get within the £85,000 limit can be administratively tedious.

3. Does it affect your financial plan?

As part of the planning we do, cash serves two purposes:

o Having a contingency fund for unexpected expenses which can arrive when we least expect

o For those clients who are drawing from pensions and investments, it is about having the peace of mind knowing expenditure can be met by having an allocation to cash

Can a price be placed on having peace of mind that your financial plan remains on track to support your choices now and in the future?

4. Look at total return

Where your overall portfolio is allocated will have a greater impact in determining whether the assets you have accumulated will outstrip your life. Gone are the days of being solely dependent on yields to meet household expenses

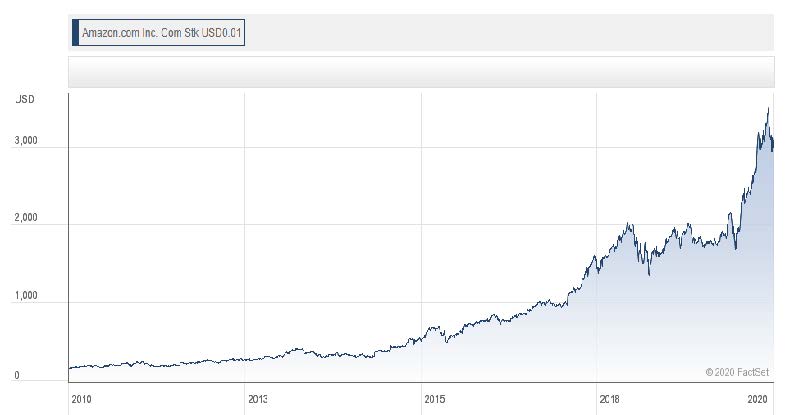

Here is an example, Apple and Amazon are two of the largest companies in the world and both have seen a tremendous period of growth in turnover and value. However, both went through extended periods of paying no dividends. Apple stopped paying dividends in 1996 and did not restart until 2012. Amazon has never paid a conventional dividend. An investor who solely concentrated on yields would have lost out on great potential capital growth in these companies if they had been excluded from portfolios on the basis of zero dividends.

We believe clients should be able to live life on their terms and we spend time understanding what makes you abundant and build a plan so you can enjoy the journey. This may include considering unconventional approaches to ensure the wealth accumulated can meet your lifetime requirements.

5. Can Satis help?

We have successfully navigated clients through various transitions in their lives and continue to see greater demand. In the midst of regulations and where best to place your money, we place emphasis on where your assets sit as part of your future plans and aspirations.

Did you know…?

With your permission, we can access information about your NS&I accounts. This is an example of how we simplify clients’ lives so that we can focus on the most important aspects i.e. you.