Bonds play an important role in most investors’ portfolios, providing more certain outcomes than equities for more cautious investors at the price of lower returns, and downside protection at times of equity market trauma for more adventurous investors. Bonds, however, are not all the same, ranging from cash-like to more equity-like. So, the choices that an investor makes are important. Let’s take a look at the three key choices in turn.

Choice 1: Shorter vs. longer

Over time, the return that you receive from owning bonds is closely related to the yield-to-maturity at the time you buy them. If you hold a bond to its maturity date, that is the return you will receive assuming all coupon (interest) payments are reinvested. Using UK government bond (gilt) data from 1970, we can run a simple analysis and look at the average yield-to-maturity of bonds from 1.5 years maturity up to 15 years. The results are plotted below, against the volatility of returns of a constant maturity bond portfolio at each chosen maturity. What is evident is that there is very little yield pick-up from owning longer-dated bonds than shorter-dated bonds (around 1% p.a.), but the risk level picks up dramatically. Note that during this period the annualised volatility of returns (risk %) of global equities was measured at around 15%[1]. On this basis, 15-year bonds had around three-quarters of the risk of global equities compared to just over one-third for 5 year bonds.

Figure 1: Shorter-dated bonds have favourable risk-to-reward characteristics (1/1970-3/2023)

Data source: Albion Constant Maturity Indices (ACMI). Yield data – Bank of England.

Choice 2: High quality borrowers vs. low quality borrowers

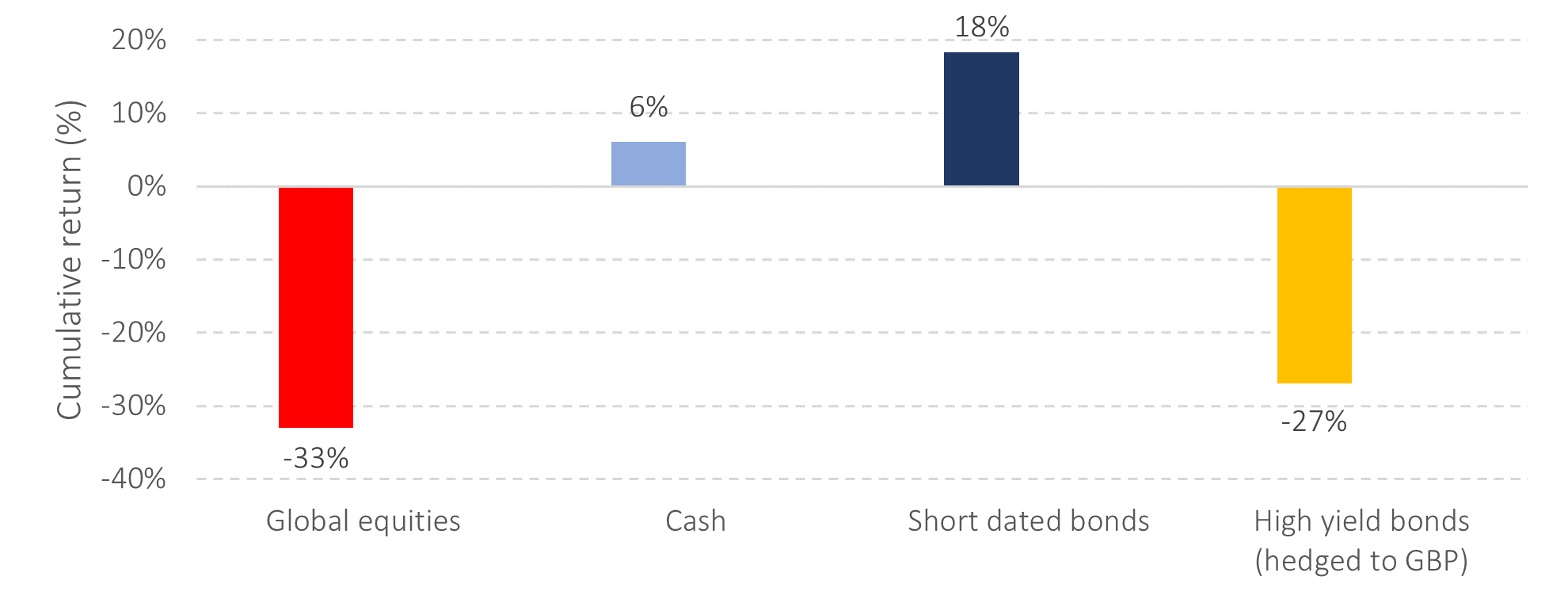

The roles that bonds play in both more cautious and more adventurous portfolios are primarily defensive. As one moves away from the strongest borrowers (AAA and AA), yields rise as borrowers become weaker. As one slips below investment grade (any bonds rated below BBB) into ‘high yield’ bonds, investors take on a greater degree of the risk. Lower quality corporate bonds have an increasing correlation to the borrower’s equity, reflecting the risk of default on their debt. At times of equity market crisis – when weaker companies may be in trouble – higher quality bonds tend to perform better than lower quality bonds, providing a useful defensive holding in a portfolio, as the figure below illustrates.

Figure 2: High quality bonds offer defensive qualities – Global Financial Crisis 11/07 to 2/09

Data sources: Morningstar Direct © All rights reserved. Albion. Bank of England (refer to endnote)

Choice 3: Hedged vs. unhedged

Buying foreign bonds increases the opportunity set for investors and diversifies the risk of interest rate movements across markets. A foreign bond comes with currency risk between the currency of issue (e.g. US dollars) and the base currency of the investor (e.g. Sterling for a UK investor). Currency exposure introduces an equity-like risk into the bond portion of portfolio, creating a volatile asset. Let’s run a quick experiment. For simplicity’s sake, imagine that you placed a deposit in US dollars for one month and rolled it over each month without hedging the currency, from 1990 to 2022. Imagine too, an alternative scenario where you hedged the US dollars back to GBP, in effect ending up with a synthetic GBP cash deposit, as the cost of hedging is calculated using the difference between the two interest rates (unfortunately there are few free lunches in investing!). The chart below reveals the material difference in annual outcomes.

Figure 3: Currency adds material volatility to the equation (1990-2022)

Data source: Federal Reserve and Bank of England.

Investors need to be able to talk themselves out of a sensible starting point of shorter-dated, higher-quality, currency-hedged bonds, when deciding what type of bonds to own.

Risk warnings

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

![]()

About the author

Albion Strategic

Albion were born in 2001 and initially focused on working with private banks and family offices in the US. In 2006, they began consulting to leading financial planning companies in the UK, many of which have grown into robust, successful and respected firms with strong regional brands.

In that same year, Smarter Investing was published and is now in its third edition. Their systematic approach to investing was tested in the Credit Crisis of 2008-9 and survived with honours. The Albion approach has also been shown to be robust in the more positive markets since, capturing the bulk of returns offered by the markets.

Theory, evidence, logic and patience are the key ingredients to investing success.

[1] Annualise volatility of returns represents the range either side of the (arithmetic) average return that two-thirds of outcomes fell. A high number represents a greater uncertainty of outcome than a lower number.